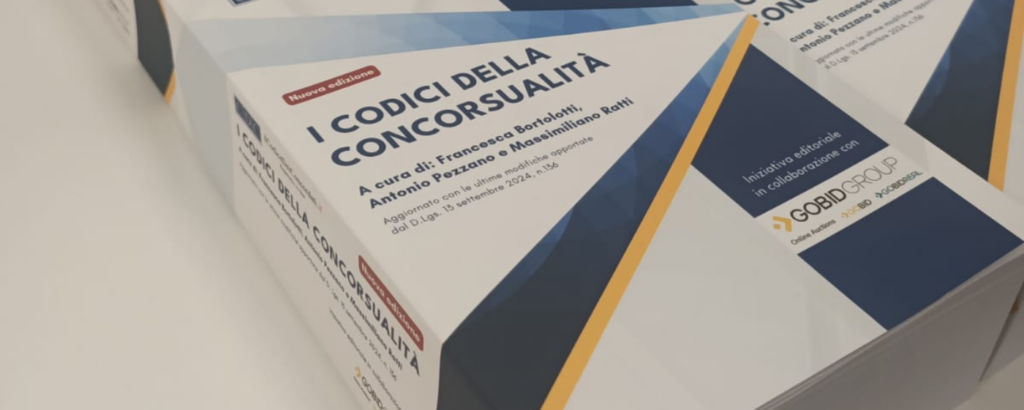

2025 has confirmed itself as a year marked by significant appointments and high strategic value transactions for Gobid Group, further consolidating a track record built on successful sales operations and on a structured, digital operating model focused on maximizing auction values.

Within the context of insolvency proceedings and judicial sales, the choice of an operational partner represents a decisive factor for the proper conduct of the liquidation process and for achieving realization objectives. It is precisely in this scenario that the numerous high-profile professional appointments entrusted to Gobid Group during 2025 find their key interpretation: trust reaffirmed by professionals involved in the proceedings, based on technical expertise, the ability to manage complex assets, and operational transparency. Requirements that are now essential to address an increasingly articulated regulatory and market framework in constant evolution.

Complex Assets and High Strategic Value Transactions

Among the most significant appointments of the past year stand out assets characterized by high technical and commercial complexity, which required an integrated approach and deep knowledge of the relevant markets.

In the port infrastructure sector, Gobid Group managed the enhancement strategy and the search for potential buyers for a new intermodal hub in Venice: an area of over 32 hectares dedicated to integrated logistics and combined transport. An operation that required cross-disciplinary expertise, ranging from offer structuring to targeted promotion toward specialized investors.

Also noteworthy is the activity carried out in buildable land and residential assets, with mandates acquired for the sale of areas in the provinces of Rome and Ascoli Piceno, as well as apartments and garages in the Marche and Umbria regions originating from a significant proceeding of the Court of Ancona. In this case, operational timeliness and correct market exposure of the assets led to numerous awards already within the first months following acquisition.

In the commercial real estate segment, Gobid Group managed the sale of an entire complex in the province of Padua, consisting of over 12,000 square meters distributed across two levels and equipped with ample parking. An asset that required highly selective promotion and constant oversight of the sales phases.

Intangible Assets and New Opportunities in Proceedings

Alongside traditional assets, 2025 saw growing attention toward intangible assets, increasingly present within insolvency proceedings. In this area, Gobid Group has gained significant experience in the management and auction maximization of pro soluto tax credits deriving from the 110% Bonus, as well as in the promotion of digital and technological assets such as Facility Live, a semantic search software developed in Italy.

These operations confirm how regulatory and market evolution now requires specific expertise also in the enhancement of non-traditional assets, where correct asset positioning and the identification of target potential buyers prove decisive.

Business Transfers and Protection of Value Continuity

In line with the objectives of the Italian Code of Corporate Crisis and Insolvency, Gobid Group has also been involved in managing transfers of business units and entire companies, operating in heterogeneous sectors such as pharmaceuticals, retail, and large-scale distribution. These transactions require a highly structured approach, capable of combining procedural requirements, rapid timelines, and the safeguarding of industrial value.

Special Vehicles and Vintage Cars: Enhancing Highly Collectible Assets

Throughout the year, there were also transactions involving special vehicles and vintage cars—assets that require particularly careful management from a documentary, valuation, and promotional standpoint. Thanks to targeted asset positioning and dedicated communication campaigns, these vehicles were transformed into highly participated online auctions, capable of attracting collectors and enthusiasts also at an international level. This is an area in which Gobid Group’s experience in targeted promotion and digital sales management has made it possible to achieve concrete results in terms of competitiveness and market interest.

The Gobid Group Model Built on Experience and Professionalism

Every asset for which Gobid Group acquires a sales mandate represents a challenge. A challenge that is managed each time with a dedicated project, involving specialized teams from the very first phases of documentation analysis. The goal is to build a transparent, efficient sales path oriented toward maximizing results.

The Gobid Group operating model is based on three fundamental pillars: integrated management of the procedure in every phase, targeted visibility of assets toward potential buyers, and the use of advanced digital tools capable of simplifying the professional’s work and expanding market reach.

In a scenario where insolvency proceedings are becoming increasingly complex and assets increasingly heterogeneous, relying on a partner with multidisciplinary expertise and consolidated experience represents a strategic lever to operate effectively, in compliance with timelines and liquidation objectives.

Would you like to stay constantly informed about the topics that truly interest you?

Help us send you increasingly personalized communications tailored to your needs. Let us know your preferences!